FreshBooks tax preparation software

How Does Tax Filing Softwarе Work?

Once you’ve entered your financial data, the software uses complex algorithms and consults tax laws to calculate your tax liability or refund. Based on your financial situation and details, it then generates the necessary tax forms, like the 1040 or Schedule C.

These tax software tools are generally very user-friendly and designed to accommodate a wide range of users, from home owners to freelancers, small businesses, and large enterprises.

They typically offer intuitive interfaces that make it easy to input your financial details, and many provide real-time calculations so you can instantly see how your actions affect your tax situation.

Some software, like FreshBooks, caters to freelancers and small businesses, offering features like expense tracking, invoicing, and even mileage tracking to simplify the entire financial process.

So, whether you’re a self-employed freelancer or managing a growing business, tax software can streamline the tax preparation process and help you easily navigate the complexities of tax regulations.

The Best Tax Preparation Software in 2023

Reviewed

Eager to get your hands on the best tax planning software? Read on as we’ll now take a deep dive into all of our top tax software, discussing details like pricing, pros and cons, and the best features on offer.

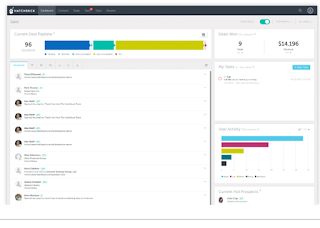

1. FreshBooks — Overall, the Best Tax Software, with Double-Entry Bookkeeping

FreshBooks’ detailed tax reports provide you with all the numbers you need to painlessly file your taxes each year. Since it’s also known as one of the best accounting software packages, it tracks your revenue and profits better than anyone.

You get a summary of your sales taxes plus a report on your profit and loss over the last year. Together, these reports help you calculate your taxable income and file accordingly.

FreshBooks offers a full accounting platform with tons of features, as well as comprehensive double-entry bookkeeping.

Double-entry bookkeeping is the process of recording a transaction into two accounts – debits and credits. This means that for every transaction that’s recorded as a debit, there must be an equal transaction that’s recorded as a credit. This makes it easier for you to track where your money went.

FreshBooks has more than enough resources for you to complete your taxes. However, if you need additional help, you can sign up for the Accounting Partner Program and get matched with accountants and tax experts, who are personally vetted by Freshbooks’ in-house team.

You can also invite your accountant to your FreshBooks account. They can be added just like a regular team member, and you can control the data they can access. Together, you can review your financial reports in real-time and file your taxes before the deadline.

In short, FreshBooks is an ideal accounting tool for managing your business and paying your taxes on time, offering a far broader toolset than products like TurboTax.

Pros

- Access to detailed tax reports

- Double-entry accounting supported

- Give your accountant controlled access

- Connect with FreshBooks-certified tax experts

Cons

- More focused on accounting and less on taxation